Business

Yoti MyFace liveness white paper

Learn how Yoti’s liveness solution can help you defeat spoof attacks Liveness detection is an essential part of any verification or authentication process. It gives you reassurance that you are dealing with a real human. Read our latest white paper on liveness to learn how Yoti’s MyFace liveness solution can help defeat presentation attacks including: Paper image Mask Screen image Video imagery Deep fake video Injection attacks Bot attacks Key takeaways from the report Yoti’s MyFace solution is iBeta Level 3 approved with 100% attack detection. Why liveness is important for verification and authentication. The difference between

What are liveness checks and why do they matter?

A lot of life happens online now. You can open a bank account from your sofa. Start a new job without meeting anyone in person. Prove your age with a selfie. Interact on gaming platforms. Use a dating site. Rent a flat. Meet people you’ve never seen in real life. But all of these things only work if one thing is true: there’s a real person on the other side of the screen. When that assumption holds, things feel easy. When it doesn’t, people lose money, accounts get taken over, services grind to a halt and trust disappears fast.

How we build our AI models

At Yoti, AI is not a general-purpose experiment. Instead, it is a set of purpose-built tools embedded directly into our identity, authentication and age verification products, designed to deliver secure decisions quickly while not collecting or processing unnecessary data. Rather than using large, general-purpose AI systems, we build and deploy small, specialised models that each solve a clearly defined problem. This approach gives our customers stronger security, better privacy outcomes, faster performance and greater confidence in how decisions are made. How do our AI-based checks work? At Yoti, our approach is to use multiple models to perform very

Yoti helps platforms navigate Australia’s new social media age restrictions

Australia’s new age restriction laws for social media come into effect today, signalling a major shift in how online services must support age-appropriate access for younger users. As platforms prepare for increased regulatory scrutiny and tight compliance timelines, Yoti is enabling our social media partners to deploy trusted, privacy-preserving age assurance at scale. These reforms, led by the eSafety Commissioner, require major social media platforms to take ‘reasonable steps’ to stop under 16s from creating an account or using their services. There are no exceptions to this age limit, not even those with parental consent. The rules apply to

How strong authentication powers Zero Trust and protects against cyber threats

Until recently, organisational cybersecurity typically relied on a fortress mentality, by building a strong perimeter with firewalls and VPNs, and trusting everything inside. But in today’s digital world of cloud apps, remote work and hiring, supply chain integrations, virtual connections and sophisticated attacks, that approach is no longer enough. Once criminals breach the walls, they can often move freely and undetected. If a business can’t reliably confirm who’s accessing its systems, it leaves the door open for cyber criminals. When authentication is weak, malicious actors can: Steal employee or customer login credentials through phishing and use them to access

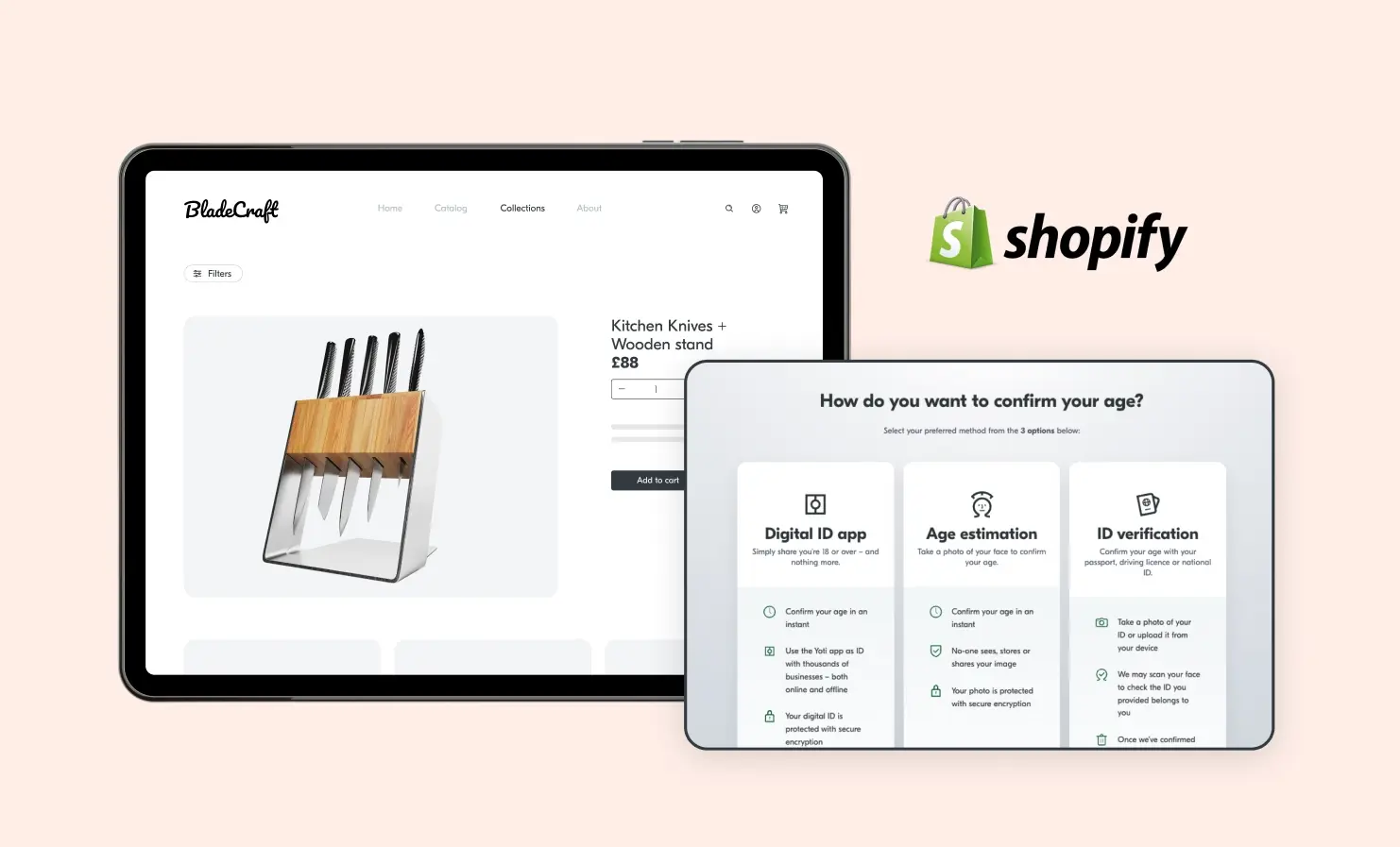

Yoti age checks now available for Shopify stores

If you sell age-restricted products on Shopify, we’ve got good news. It’s now easier than ever to add secure, seamless age checks to your online store. Yoti has now officially integrated with Shopify – one of the biggest ecommerce platforms in the world. That means Shopify merchants can now offer fast, privacy-preserving age checks for their customers. If you’re selling alcohol, vapes, knives or other age-restricted items, this integration helps you meet legal requirements without adding unnecessary friction to your customers’ journey. Why does this matter for Shopify merchants? Shopify powers millions of online businesses, including both independent