Identity verification

What is synthetic identity fraud? How it works and how to prevent it

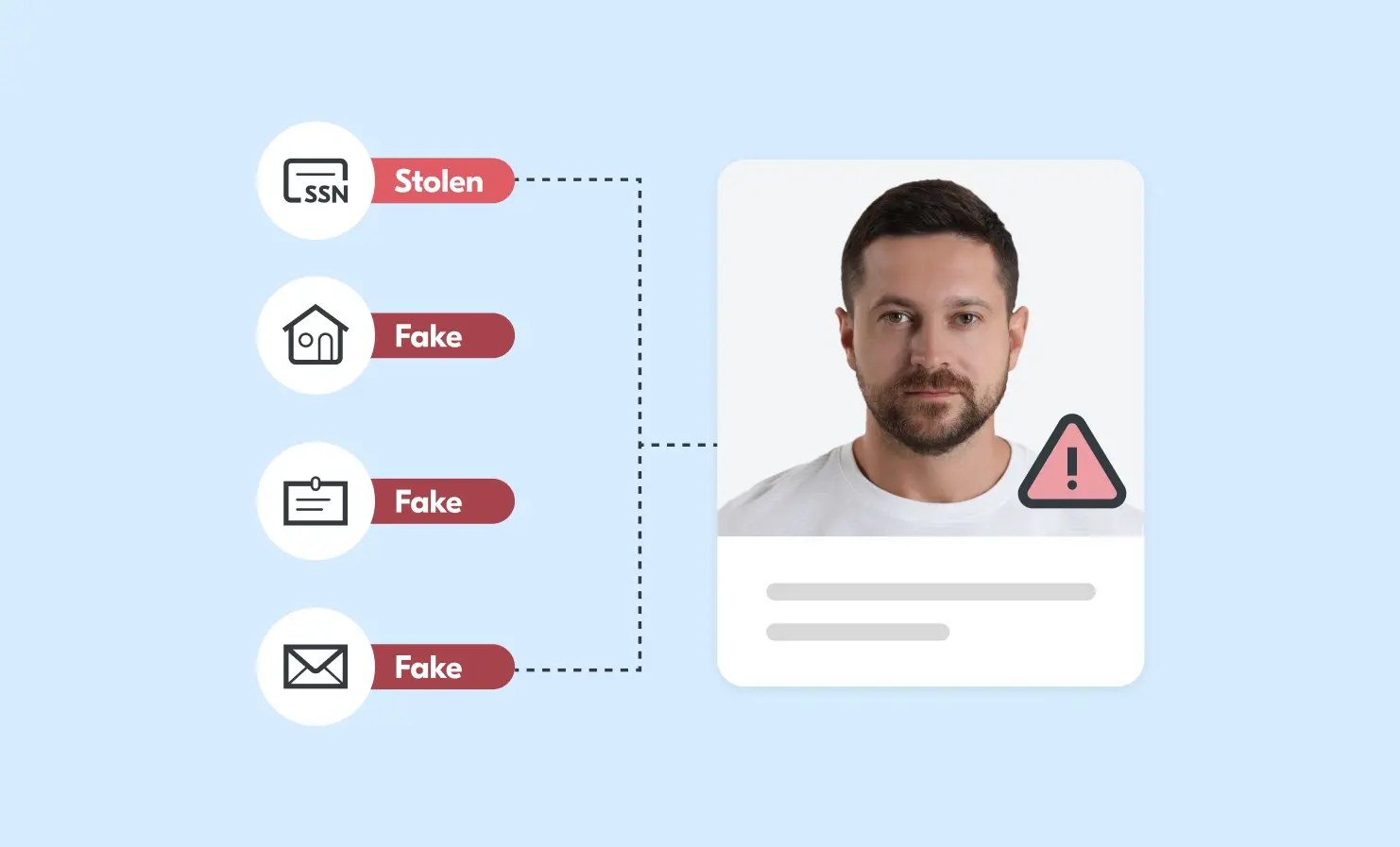

What is synthetic identity fraud? Synthetic identities are fake identities, built by combining real and made-up information, earning them the nickname “Frankenstein IDs” due to their pieced-together nature. Synthetic identity fraud is different to traditional identity fraud as it doesn’t involve an obvious, immediate consumer victim. These fake profiles are designed to mimic real customers, often slipping past traditional fraud detection systems because they don’t raise typical red flags. As a result, the primary victims of synthetic identity fraud are businesses and lenders, who bear the financial losses. How synthetic identities are created and used

Identity verification: the facts

It’s becoming increasingly essential to check that users are who they say they are. The rise in cyber attacks, data breaches and online financial crime has pushed companies across multiple industries to adopt more reliable and advanced verification methods. As a result, identity verification has become a crucial part of securing online transactions and interactions. It helps reduce identity theft, protect sensitive data and allows businesses to comply with regulations. We believe people and businesses should make up their own minds about whether they’d like to use our identity verification technology – based on the facts. [vc_btn title=”Read the facts”

Why early detection is critical in stopping deepfake attacks

Digital identity and age verification are becoming integral parts of customer onboarding and access management, allowing customers to get up and running on your platform fast. However as customer verification tools become more advanced, so too are fraudsters seeking to spoof systems by impersonating someone, appearing older than they really are or passing as a real person when they’re not. Deepfake attacks, which can mimic a person’s face, voice or mannerisms, pose a serious threat to any business using biometric customer verification. In this blog, we explore why detecting deepfakes early is essential for maintaining trust, security and regulatory

Protecting your business and customers from account takeover

In today’s digital world, we have dozens of online accounts. These range from online banking to social media, dating apps to gaming platforms. Though convenient, this opens the door to the rapidly growing threat of account takeover fraud. Account takeover fraud is surging, with global losses expected to hit $17 billion by the end of 2025. The number of account takeover attacks is rising sharply too, increasing by 24% year-over-year in 2024. This blog walks you through what account takeover is, how it happens and what you can do to prevent it. What is account takeover? At its

Effective ways to improve your AML compliance

Managing financial crime presents a complex challenge for financial institutions. Due to its covert nature, the full scope of money laundering is difficult to truly know. The United Nations Office on Drugs and Crime (UNODC) estimates that between 2-5% of global GDP (up to $2 trillion in US dollars) is laundered every year. As financial crime becomes more sophisticated and regulations grow tighter, businesses must prioritise robust anti money laundering (AML) measures. Industries like banking, fintech and financial services need strong AML processes to protect themselves from fraud, penalties and legal risks. We explore how your business can strengthen

What is identity verification?

As we spend more of our lives online, protecting our personal data has never been more important. Identity verification helps businesses check their customers’ identities whilst allowing people to navigate online services with confidence. Understanding identity verification is essential. We break down what identity verification is, why it matters and how it works. We also discuss the different methods used for verifying identity and the benefits of secure identity checks. Why do we need identity verification? Identity verification helps protect both individuals and businesses from things like identity theft, fraud and other malicious activities. It’s especially important in