Articles

Tackling child sexual abuse online with the Safety Tech Challenge Fund

We’re delighted to announce that the Safety Tech Challenge Fund 2021 has awarded Yoti and our collaborators with not one, but two rounds of funding. Working in partnership with Galaxkey & Image Analyzer and DragonflAI, we are looking to tackle child sexual abuse and demonstrate how end-to-end encryption and AI-powered image analysis could be used to create secure solutions that protects young people online. Between 2019 and 2020, over 10,000 cases of online child sexual abuse were reported to police forces across the UK. In efforts to create change to prevent such crimes, the UK

Our age assurance solutions are approved by German regulators KJM and FSM to protect young people online

We’re excited to announce that The Commission for the Protection of Minors in the Media (KJM) has approved our facial age estimation tool (formerly known as Yoti Age Scan) to be used in the German market to protect young people online. You can read the KJM press release here. This follows our approval from the German Association for Voluntary Self-Regulation of Digital Media service providers (FSM) in 2020, which allowed German people to use digital age estimation and age verification technology for the first time ever to access digital adult content. You can read the FSM seal text here.

Protect yourself and your pets with Post Office EasyID and Yoti peer-to-peer checks

Scammers delight with fake online profiles Identity-related fraud is accelerating in the real world and particularly online, where it’s easy to hide and act behind a fake profile unchecked. Despite calls from victims and campaigners, most platforms don’t want to add friction into their user journeys in fear that people will migrate to another site. Fraud comes in a number of shapes and sizes, and the consequences can be physically, financially, and emotionally damaging. Whether someone is trying to sell stolen goods, committing romance scams, catfishing, or advertising property rentals that don’t exist, there are

Get ahead of new age and identity verification regulations with our handy guide to know your customer (KYC) processes

It’s no longer financial institutions, real estate, art dealers, casinos, lawyers, and accountants who are the main targets for financial crimes online. Criminals are finding it harder to use them for money laundering due to rigorous regulations and effective know your customer (KYC) processes. To go undetected, they have set their sights on online multiplayer gaming, online marketplaces, FinTech, online gambling and many more small and medium businesses. Lawbreakers are attracted to these platforms because they have little to no anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. For example, multiplayer online gaming platforms have experienced

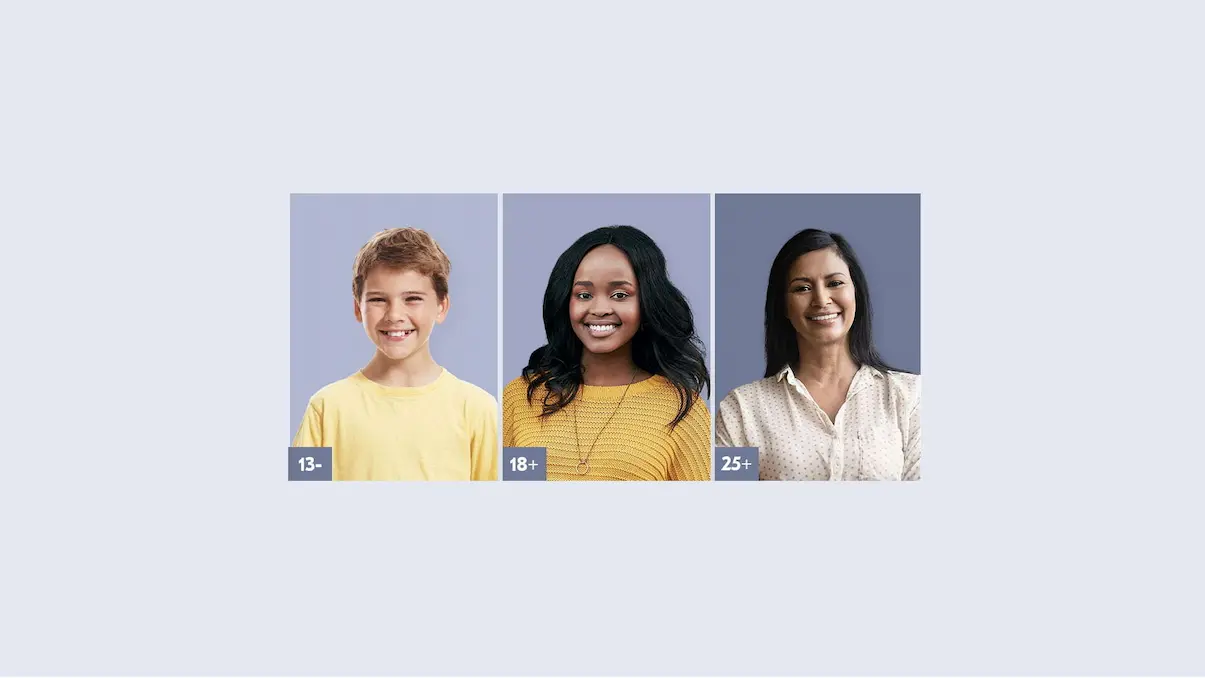

In response to the ICO’s opinion on Age Assurance for the Children’s Code

The Age Appropriate Design Code is a statutory data protection code of practice from the ICO that applies to providers of Information Society Services that are likely to be accessed by children, such as apps, online games, and web and social media sites. The ICO released an Opinion that looks at how age assurance can form part of an appropriate and proportionate approach to reducing or eliminating risks and conforming to the code. This included opinions on age verification and age estimation technologies. We believe that some of the generalisations made about age estimation do not

How to strike a balance between fraud prevention and seamless customer onboarding

Our Identity Verification solution makes onboarding as hassle-free as possible for your users. Digital identity verification has become a crucial part of onboarding customers, with businesses needing to check that they are genuine, protect customers’ data and mitigate fraud. Having identity verification embedded into your online customer journey ensures you have identified and verified your customers’ identities. Even so, it can be challenging to establish a balance. Finding the best way to streamline the customer’s digital experience while complying with know your customer (KYC), anti-money laundering (AML) industry requirements isn’t easy. Businesses are often forced