News

Introducing Yoti Keys: privacy-focused, seamless and anonymous age verification

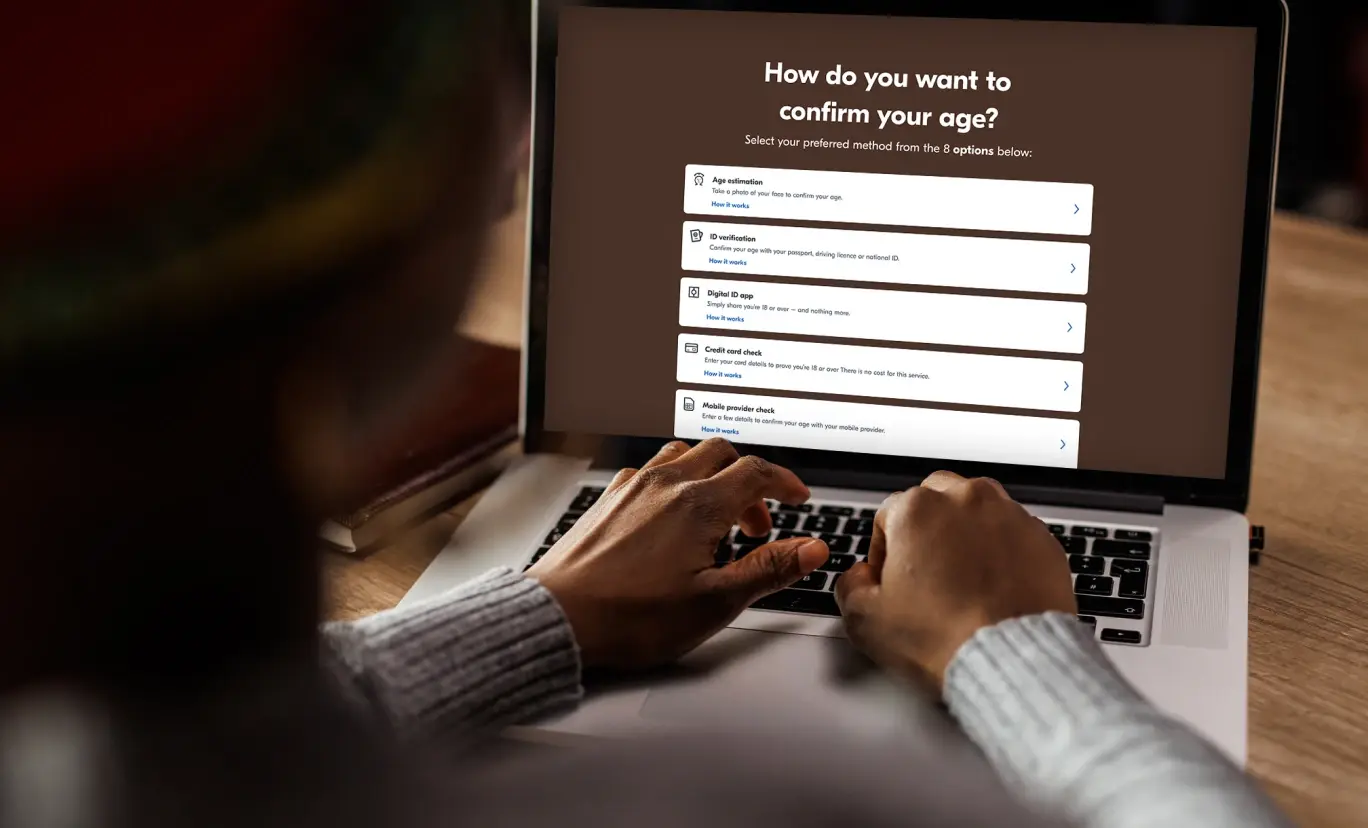

We’re excited to announce a new age assurance solution: Yoti Keys. Yoti Keys let people verify their age once and gain continued access to an ecosystem of websites without having to prove their age again, regardless of if they are using an incognito or private browser. A Yoti Key, using passkey technology, doesn’t store any personal information. This helps people to remain completely anonymous but verified – all on their device. How a Yoti Key works Complete an age check: The user completes an initial age check to prove their age. They can choose which method to use,

Deepfake attacks: Rising fraud trends and our experience in preventing them

In 2024, we witnessed a significant increase in the number of deepfake attacks, or injection attacks during age and identity verification checks. The percentage of attacks increased from 1.6% to 3.9%. In absolute terms, this is a significant rise in the total number of attacks we have detected as we significantly expanded our services in 2024. We now perform over 5 million checks per week across all our services. With the introduction of various regulations globally, companies have been obliged to implement more robust age or identity checks for their users. We have seen injection attacks across identity verification

Yoti responds to Ofcom’s final guidance on highly effective age assurance for Part 5 pornography providers

Ofcom has published the final guidance on highly effective age assurance for (Part 5) providers of pornography, under the Online Safety Act. There are a lot of good principles and effective guidance to ensure children are protected online and there is a clear deadline of July 2025 for all sites (be that pornography sites or social media platforms which allow pornography) to have age verification in place to prevent children from accessing adult content. We are pleased to see that Ofcom has listed several popular age assurance methods, such as facial age estimation, Digital ID wallets, and document verification,

The Sunday Times 100 Tech – Yoti named as one of the UK’s fastest growing tech companies

17th January 2025, London, UK – Yoti, a leader in digital identity and age assurance, has been named in the Sunday Times 100 Tech, a ranking of Britain’s fastest-growing private technology companies. This achievement reflects Yoti’s impressive 170% Compound Annual Revenue Growth (CAGR) over the three years to March 2024, securing its position at number 13 on the list. Robin Tombs, CEO at Yoti said: “We’re delighted to be recognised as one of the UK’s fastest growing private technology companies. Since 2014, Yoti’s innovative technology is transforming how people prove their age and identity. Our technology is supporting millions

Digital IDs soon to be accepted as proof of age for buying alcohol

It’s the news we’ve been waiting for. People will soon be able to use digital IDs to prove their age when buying alcohol. The Government has shared an update, confirming the change will come in next year. Digital IDs will give people an easier, safer and more secure way to prove their age when buying alcohol in high street pubs, supermarkets, convenience stores, nightclubs, pubs and bars. This is a significant step forward and demonstrates the growing importance and demand for reusable Digital IDs. In the UK, over five million people have already downloaded our Digital ID apps. These

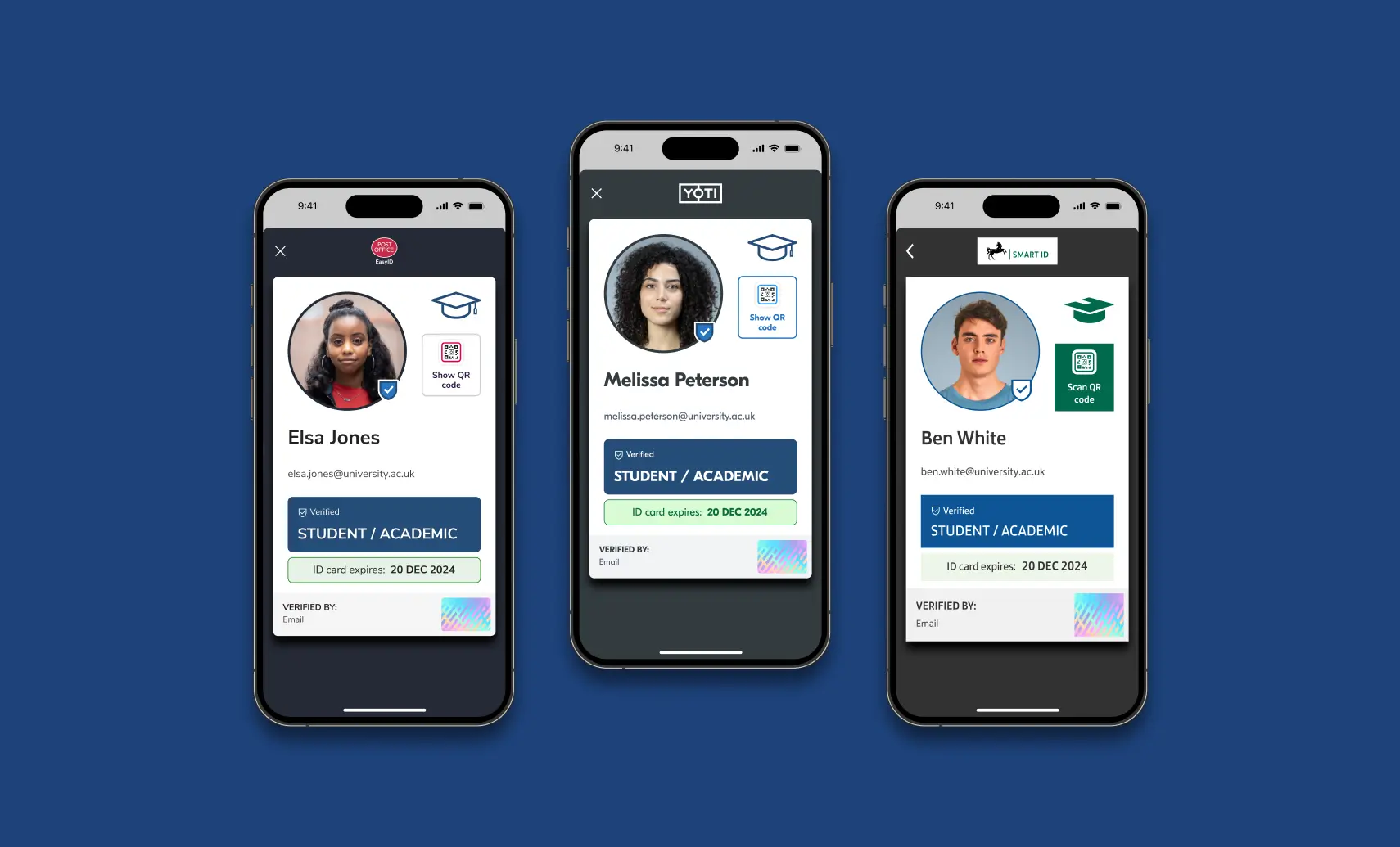

Introducing verified Student IDs on your phone

We’re excited to introduce Student IDs – a new feature that allows students to confirm their student status through our Digital ID apps. With nearly three million students in the UK, we’re proud to make student verification simpler for millions. With a verified Student ID, students can quickly and easily prove they are a student, without having to show a physical student card. They display only the key information, such as their photo, university email, and verified student status, directly to businesses. This approach enhances students’ privacy and security while providing businesses with reliable confirmation of student status.