In this blog series, our CEO Robin Tombs will be sharing his experience, whilst focusing on major themes, news and issues in the world of identity verification and age assurance.

This month, Robin talks about the future of digital IDs in the UK, his hopes for our Digital ID network and thresholds for facial age estimation.

Visions for digital IDs in the UK

Tony Blair recently stated in The Times that high adoption of reusable digital ID in the UK is inevitable. But that’s only half of the digital ID story.

He says, “Digital ID is a personal enabler. It allows you to simplify your transactions with the government and in time it will become the simplest way you deal with your private sector interactions as well. Rather than having to prove your identity in all sorts of different ways, it allows you to have one single source of truth and it prevents people misusing your identity”.

The former Prime Minister’s assumption is that this digital ID will be a government account or app. But it’s much more likely reusable digital ID users will choose to ‘own’ and use:

- a government-issued digital ID for some things, particularly if the Government mandates its use when interacting (proving ID or authenticating) with government services and public sector bodies;

- either an Apple ID or Google ID wallet (depending on the phone they own) for some interactions in the private sector

- a UK government-certified private sector digital ID wallet for some interactions in the private sector, with a small number of viable wallets in this group networked to maximise coverage for businesses and utility for individuals.

Some individuals may only use one of the above options. For example, they may use the government’s digital ID for easy online interactions with the government. However, many will use either two of these or even all of them. My guess is that by December 2028, about 30 million Brits out of the 60 million individuals who are over the age of 13 (from a total of 69 million population at that time), will have at least one reusable digital ID wallet. But between 20 million and 25 million will have two or three of the above. This will total between 60 million and 70 million digital ID wallets in use.

There are some interactions between individuals and some organisations, both UK and non-UK based, where many individuals will want to avoid, or won’t be able to use, their government-issued digital ID app. Others won’t believe any promise that the Government or security services make about not looking at users’ interactions. As a result, these users will want to use a private digital ID wallet when they can.

Being a digital ID wallet that falls into the third category but isn’t networked into the Digital ID Connect network (or any similar network that may emerge) will be very high risk. There’s likely only room for two of these networks at scale in a country. Businesses will want a large portion of digital ID network coverage, such as 40-50%. They won’t want 2% or even 15% coverage from one non-networked digital ID. Individuals can very quickly switch from using a non-networked digital ID, that isn’t very widely accepted, to a free networked digital ID such as Yoti, Post Office EasyID or Lloyds Bank Smart ID to immediately boost the utility they get.

I doubt in the next 4 years of this parliament that the Government will try to pass legislation mandating use of a government-issued digital ID. But, if by 2029, the majority of individuals are happily using a mix of the digital ID wallets mentioned above, some in the government will be tempted to put forward the case for mandatory use of a national government digital ID.

But most people in the UK will still use private ID wallets for lots of things they don’t want to use, or can’t use, the UK Government’s digital ID for.

The organic growth of our Digital ID network

Currently, Yoti doesn’t spend any money on consumer ads to attract individuals to get a Yoti Digital ID. Most individuals download Yoti because:

- a business promotes and accepts Yoti for proof of identity or age

- a Yoti user recommends Yoti to a friend

- an individual reads about Yoti in the press

- a Yoti user wants another person to get Yoti for a peer to peer check (such as two people meeting for a date, or a buyer and seller)

The UK, France and the US are 3 of our top 5 user countries. They fuel a lot of Yoti’s growth.

In the US, many states have been introducing age verification laws for porn sites over the last 18 months. This has driven more than 400% of our growth over the last year and 132% of our growth over the last month when age verification laws in Florida and South Carolina came into effect. Fines for non compliance in the US are very high, so more and more online porn sites are giving viewers the option to prove their age with both Yoti facial age estimation and with the free Yoti Digital ID wallet. The wallet is free for businesses, globally, to receive ‘over 18’ attributes.

In France, new age verification regulations for porn sites came into effect on 11 January 2025, which explains the big jump in growth.

In the UK, Yoti is much better known – over 5 million individuals have already ‘got Yoti’. Most of the 23% growth over the last month is driven by the regular mentions of Yoti in the press. This is largely down to the UK Government’s announcement that before the end of 2025, Yoti, and other UK government-certified digital ID wallets, are now futureproofed as digital proof of age to buy alcohol in licensed premises. From July 2025, we also expect an increase in downloads in the UK when all businesses displaying online porn to UK viewers must check viewers are over 18.

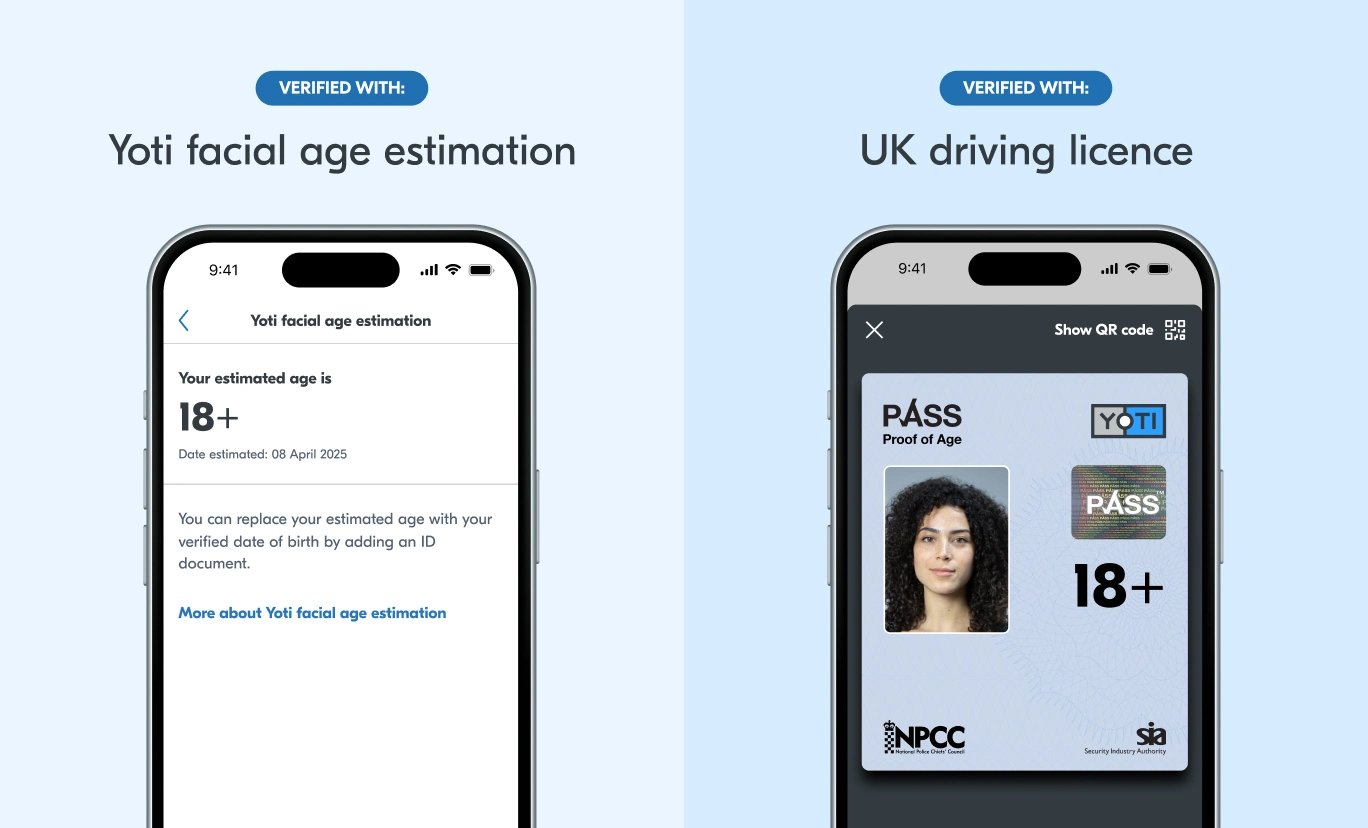

Yoti would get a lot more wallet downloads from porn users, but currently approximately 90% of porn viewers choose to use facial age estimation to prove their age. Since one of Yoti’s key principles is to act in the interests of our users, offering them a privacy-preserving way to prove their age is important, even if that means slower adoption of our Yoti digital ID wallet.

We want to see tens of millions, and eventually hundreds of millions, of individuals globally choose to get the Yoti digital ID wallet to make their lives easier, prove their age and identity and protect themselves from fraud. But to do this, we must earn individuals’ trust across many countries before they choose to do this, which will take many years.

Choosing the right age thresholds for facial age estimation

From July, many businesses will need to perform age checks to comply with certain requirements of the UK Online Safety Act. Lots of businesses ask us what age threshold they’re required to set to ensure Yoti facial age estimation is ‘highly effective’.

With an age threshold of 20, our current facial age estimation model has a false positive rate of 1.42% for an evenly distributed group of 13-17 year olds. This means 1.42% of 13-17 year olds will be incorrectly estimated to be 20 or over and, in practice, would be granted access to content with an age requirement of 18+. The false positive rate drops to 0.77% for a threshold of 21 years, 0.46% for a threshold of 22 years and 0.24% for a threshold of 23 years.

Age thresholds are helpful as shoppers are already familiar with the Challenge 25 policy. However a false positive rate is the scientific measure of a facial age estimation model’s effectiveness because world-class models will deliver a lower false positive rate than a less accurate model with the same age threshold.

Whilst Ofcom has not yet published the false positive rate that would meet its ‘highly effective’ requirement for online porn and other age-restricted content, it’d be very challenging for a regulator to reprimand or fine a business if it’s using Yoti facial age estimation with a threshold of 20 or 21 years.

But there are other cases, such as the online purchase of offensive weapons, including knives, where regulators may deem a false positive rate of 1% or 2% too high. As such, a responsible retailer using Yoti’s facial age estimation may set, or be expected or required to set, a higher threshold such as at 25 years. This equates to a false positive rate of 0.09%.

It’s difficult for regulators to set one ‘catch all’ false positive rate, as some age check methods are easier to spoof than others. After consulting widely, Ofcom has decided some standalone age check methods cannot qualify as ‘highly effective’. However, the regulator has struck a balance whereby businesses can offer a choice of age checking methods to their end users even if, in reality, some of these ‘highly effective’ methods are more highly effective than others.

Reusable digital IDs and verification using identity documents (with liveness detection and face matching) can meet a false positive rate of less than 1%, as can Yoti’s facial age estimation.

Third party database checks, such as credit card checks and mobile phone number checks, are much less likely to meet a false positive rate of 1%. This is because some teenagers can enter their parent’s credit card details. Alternatively, some minors will have been handed down a mobile phone initially bought by a parent, and some minors will enter an adult friend’s mobile number who may confirm the one time password. This message is meant to ensure the person entering the mobile number is in possession of the phone.

The German regulator does not recognise mobile phone checks as ‘highly effective’ because of these challenges. A business could request a sample of individuals who passed a mobile phone number check or credit card check to prove their age using facial age estimation (or with an identity document). However, minors could likely claim they don’t have access to identity documents and don’t want to perform a facial age estimation!

The good thing is Yoti facial age estimation is very popular, quick to do, can be easily done by over 99% of adults and is very hard to circumvent. Alongside this, Yoti’s reusable Digital ID is becoming more and more popular.