How to strike a balance between fraud prevention and seamless customer onboarding

Our Identity Verification solution makes onboarding as hassle-free as possible for your users. Digital identity verification has become a crucial part of onboarding customers, with businesses needing to check that they are genuine, protect customers’ data and mitigate fraud. Having identity verification embedded into your online customer journey ensures you have identified and verified your customers’ identities. Even so, it can be challenging to establish a balance. Finding the best way to streamline the customer’s digital experience while complying with know your customer (KYC), anti-money laundering (AML) industry requirements isn’t easy. Businesses are often forced

Online age verification: a new era

For years, businesses delivering age-restricted services online have gotten away with hiding behind a tick box. But it seems that governments are waking up to the dangers caused by exposing minors to age-restricted content. New legislation is starting to enforce more stringent online age verification for social media , dating, gaming and adult content sites. But what does this mean for the operators of those sites? How do they verify a user’s age without adding friction to their carefully crafted user experience? In a world where 40% of users are said to abandon a website if it

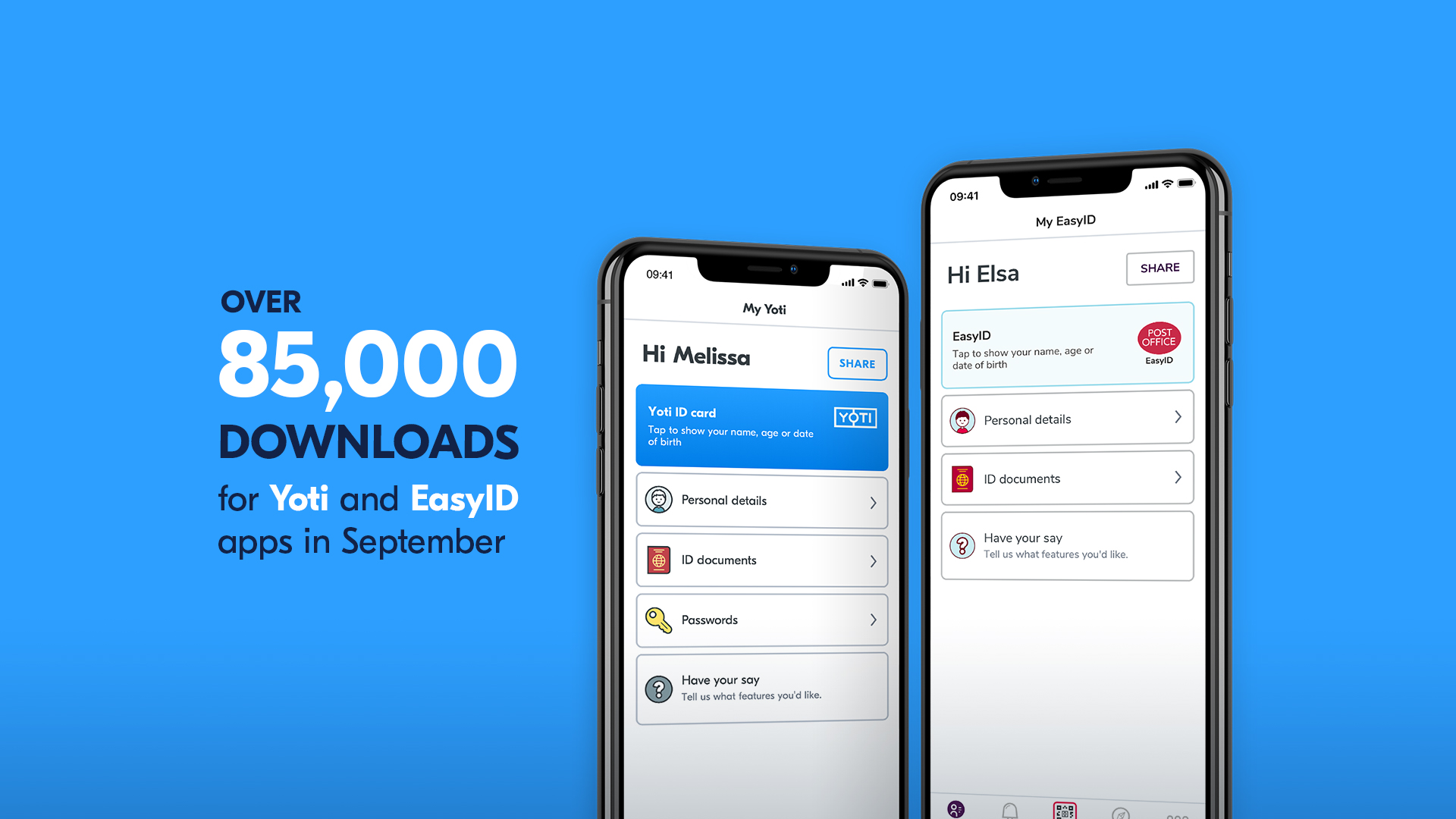

Big first steps for Post Office EasyID and Yoti creating the UK’s trusted identity network

It’s only been a month or so since the Post Office EasyID joined the Yoti ID app here in the UK and we’re delighted to share the progress we’ve made on our mission to build the UK’s trusted identity network. Over 85,000 people downloaded the Yoti or EasyID app to join our UK network in September alone, a positive indicator that many people want to take control of their data and protect their privacy with a safer way to prove who they are. Together we make it easier and safer for people to prove their identity

Introducing the Post Office PASS card: the affordable way to prove your age

People need cheaper, safer ways to prove who they are. Shockingly, 93 per cent of 16-34-year-olds take their important ID documents out with them every day, with only a minority keeping them safe and sound at home. It’s not convenient or safe to carry your passport or driving licence every day just to prove your age, so why do they do it? Well, it’s because they often need to prove their age to do everyday tasks, like buying an energy drink or going to the cinema. With that comes a greater risk of damaged, lost or

Swotties uses Yoti digital ID to verify the identity of online tutors

Yoti has partnered with Swotties to make sure that children can access safe and secure online tutoring. Swotties: connecting families with inspiring university students Swotties is an online tutoring platform on a mission to provide more affordable and accessible tutoring services for families in the UK. They connect children and parents with university students who can offer expert help in their chosen subject. They also run a give-back scheme where, for every 20 lessons booked by one household, they donate a lesson to an underprivileged child. Providing 1-2-1 online learning sessions is part of Swotties

Launching Post Office EasyID: a smarter way to prove who you are in store and online

We are delighted to announce the launch of the new Post Office EasyID app. As the name suggests, it’s your ID made easy and puts your valuable personal data on your phone and under your control. It’s free, smarter than your regular ID and lets you conveniently prove your identity in person and online, with just a tap or scan of a QR code. Following in the footsteps of digital money, we believe it’s time for Digital ID to shine and become your next phone essential. Particularly in the era where services continue to migrate online